- Market Trends in Halal-Compliant Luxury Handbags

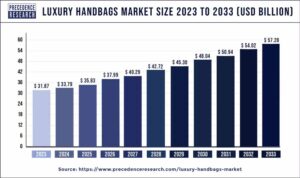

By 2033, the global luxury handbag market is expected to reach USD 57.28 billion, growing at a CAGR of 6.05%, reaching USD 31.87 billion in 2023. Halal-compliant fashion plays a significant role in this growth by catering to the increasing demand for ethically produced and religiously permissible products. As consumers, particularly in predominantly Muslim countries, seek luxury goods that align with their values, brands are innovating to offer high-quality handbags that meet halal standards. This alignment with cultural and religious preferences opens up new markets and drives the expansion of the luxury handbag industry. With the rising influence of digital marketing and the increasing availability of premium experiences online, the market is poised to attract a diverse and growing audience. Increase in working women population across the globe and emergence of several social media platforms are contributing to the luxury handbag market growth. Improvement of lifestyle, rise in disposable income, and presence of renowned brands are fueling the demand for luxury products, including handbags.

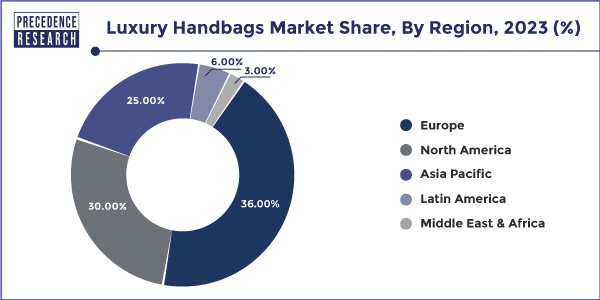

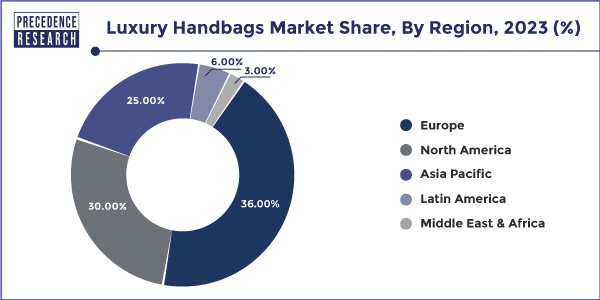

The global luxury handbags market in 2023 showcases a fascinating regional diversity, driven by factors such as economic conditions, cultural trends, and consumer preferences. Within this landscape, the Islamic population—spread across regions such as the Middle East, Asia-Pacific, Europe, and Africa—emerges as a significant and growing demographic influencing market dynamics. The Islamic population, constituting a significant consumer demographic, presents an untapped potential for the luxury handbags market, particularly in regions where this demographic is prevalent.

Leather remains the most sought-after material in the luxury handbags industry, contributing to over 40% of total revenue share in 2023. Its durability, sophistication, and association with affluence make leather products timeless investments. However, the rising demand for halal-certified leather is reshaping the purchasing decisions of Muslim consumers, who are keen on ensuring their products align with Islamic principles. Brands ensure leather meets halal standards by sourcing hides from animalsaccordance with Islamic guidelines, ensuring the process is humane and ethical. They also avoid using any prohibited substances during the tanning and manufacturing processes, such as non-halal animal fats or pig derivated chemicals. Additionally, brands often seek certification from recognized halal organizations to assure consumers of the product’s compliance with religious standards. Technology plays a crucial role in innovations in digital tracking and transparency allow brands to verify and document each step of the supply chain, ensuring compliance with halal guidelines and building consumer trust.

The Role of the Islamic Population in Market Dynamics

The Islamic population, spanning regions such as the Middle East, Asia-Pacific, and parts of Europe, represents a significant demographic shaping the luxury handbag market. Cultural preferences heavily influence purchasing decisions, as they dictate the types of products consumers are willing to buy. For example, Muslim consumers prioritize halal-certified goods, which has led to an increased demand for handbags that align with Islamic values. This trend encourages brands to adapt and innovate their offerings to cater to these specific cultural needs, thereby tapping into a lucrative and expanding market segment. The growing demand for halal-certified luxury products underscores the economic influence of the Islamic population on the global market. Brands that successfully cater to this demographic can access a substantial and rapidly expanding consumer base, boosting their revenue and market share. As a result, the brands are increasingly investing in research and development to innovate products that meet religious standards, ultimately driving economic growth and diversifying the luxury goods industry. Their influence is growing as brands look to cater to their unique preferences and values.

Asia-Pacific: A Rapidly Expanding Market

Asia-Pacific: Representing 30% of the market share, this region is the fastest-growing segment. The Asia-Pacific region’s luxury handbag market is characterized by a rising middle class with increasing disposable income and a growing appetite for high-end fashion. Consumers in this area often seek products that symbolize status and success, driving demand for iconic and prestigious brands. Additionally, there is a notable trend towards digital engagement, with many shoppers turning to online platforms for their luxury purchases, allowing brands to leverage e-commerce to reach this dynamic and tech-savvy audience. The demand has grown, and the market has expanded due to this greater accessibility. , is a vital region where Islamic populations In 2020, the total number of Muslims in Asia was about 1.3 billion, it is the largest religion in world. Asia constitutes in absolute terms the world’s largest. With countries like Indonesia and Malaysia leading the way, the rising Muslim middle class demands halal-compliant luxury goods. Muslim consumers are playing a pivotal role in shaping luxury trends by demanding products that align with their cultural and religious values.

The rising affluence of these Muslim-majority nations, coupled with the global rise of modest fashion trends, positions the Islamic population as an increasingly significant consumer group. Their increasing purchasing power and preference for halal-compliant and modest fashion are prompting luxury brands to adapt their offerings to cater to these needs. This shift not only broadens the appeal of luxury goods but also encourages brands to innovate and diversify their collections, ensuring inclusivity while expanding their reach in this important market segment. Brands incorporating halal-certified materials and culturally respectful designs stand to gain a competitive edge in this market.

Middle East & Africa: High Potential Among Affluent Consumers

The Middle East & Africa contributes 3% of the global luxury handbag market, reflecting niche but growing demand. This region, home to a substantial Islamic population, particularly in Gulf countries like the UAE and Saudi Arabia, showcases strong purchasing power and a deep affinity for luxury goods, the region boasts affluent consumers with a strong affinity for luxury goods. Affluent consumers in the Middle East and Africa exhibit a strong preference for exclusive and high-quality products that reflect their social status and cultural values. Handbags are viewed as both a status symbol and a fashion statement, aligned with the region’s cultural appreciation for opulence and elegance.

They prioritize luxury items that offer a blend of traditional craftsmanship and modern design, often seeking out limited edition or bespoke pieces. This discerning purchasing behavior is driven by a desire to showcase individuality and adherence to cultural norms, making them a vital target audience for luxury brands.Brands that adopt modest designs and cater to Islamic fashion norms can tap into this niche but lucrative market.

Europe: A Cross-Cultural Luxury Hub

Europe’s dominance in the luxury handbag market, with a 36% share, is bolstered by its international appeal, attracting Muslim consumers from across the globe. Cities like Paris and Milan are not only fashion capitals but also prime shopping destinations for affluent Islamic tourists. This demographic is known for its preference for bespoke and exclusive designs, often seeking high-end handbags during visits to European luxury hubs.

Latin America: Emerging Interest

While contributing 6% to the global luxury handbag market, Latin America is an emerging space where the Islamic population—though smaller—represents an untapped niche. Brands that acknowledge cultural diversity and inclusivity have the potential to capture attention in this developing marke

Key Takeaways for Islamic Population-Specific Strategies

- Focus on Cultural Sensitivity: Incorporating modest design principles and halal-certified materials can resonate with Islamic consumers.

- Target Affluent Demographics: Regions with significant spending power, such as the Gulf countries, provide opportunities for high-end, tailored offerings.

- Leverage Tourism: Capturing the attention of Islamic tourists, particularly in Europe and Asia-Pacific, can boost sales through exclusive marketing campaigns.

- Engage with Modest Fashion Trends: Partnering with influencers or brands in the modest fashion space could open new avenues for market penetration.

The Islamic population represents a dynamic and increasingly influential segment of the global luxury handbag market. By aligning product offerings and marketing strategies with the values and preferences of this demographic, brands can unlock new growth opportunities in both established and emerging markets.

Driven insight

Increase in working women population

More women are joining the workforce, which leads to an increase in dual-income households and increased discretionary money, which makes it possible to spend more on upscale goods like handbags. Working women are likelier to keep up with current fashion trends and invest in classic, fine accessories like luxury purses to complete their appearance. The women segment dominated the luxury handbags market in 2023. Handbags and other accessories are vital to a woman’s outfit and are frequently featured in women’s fashion trends. Women who wish to show off their sense of style and stay up-to-date drive demand for luxury handbags, which are viewed as status symbols and fashion statements.

Demand for high-end brands is driven by working women’s desire for luxury handbags as status symbols or to accessorize their professional outfits. Working women are more likely to treat themselves to luxury goods, such as handbags, as empowerment or self-reward when they have more financial independence.

Surge in usage of various social networking platforms

Social media sites are now considered influencer marketing’s fertile field. Influencers frequently feature expensive handbags in their posts, setting an example for their followers and generating demand. Users may find and share trends more rapidly because of it. Because of this, when a high-end handbag becomes popular on social media due to celebrity or influencer endorsements, it may become viral and increase demand and sales. Thereby, the surge in usage of various social media platforms is observed to act as a driver for the luxury handbags market.

Social media is a valuable tool for luxury handbag businesses to collect client feedback and do market research. Social media interactions give brands insights into consumer preferences, enabling them to customize their services accordingly.

Product Insights

The handbags segment dominated the luxury handbags market in 2023. Luxurious handbag labels such as Gucci, Chanel, and Louis Vuitton have built significant brand awareness and brand loyalty among consumers across the globe, making their handbags extremely sought-after. Numerous luxury handbag companies have enduring designs that have come to represent refinement and status over time. Customers looking for investment and fashion pieces are drawn to these classic styles. Celebrities and influencers routinely promote luxury handbag manufacturers, who show off their products to millions of followers and increase their desirability and status. The backpack segment is the fastest growing in the luxury handbags market during the forecast period. Consumer tastes have shifted in favor of more valuable and adaptable accessories. In today’s world, where people want style and practicality, backpacks provide comfort and functionality. When making purchases, younger generations give priority to authenticity and ease. Luxury backpacks align with their principles, providing millennial and Gen Z customers with a functional and luxurious combination. Backpacks are multipurpose accessories that can be used for daily use, travel, and work. Customers searching for multipurpose backpacks adaptable to various environments will find this adaptability appealing

Material Insights

The leather segment is recorded more than 40% of revenue share in 2023. Leather is frequently thought of as being superior, enduring, and wealthy. High-end leather purses are luxurious and sophisticated, tempting buyers looking for status symbols. Handbags made of leather are known for their strength and longevity. Leather handbags are a worthy investment for customers since they are more resistant to wear and tear than purses made of other materials, including fabric or synthetic substitutes. Numerous high-end companies offer leather handbag designs that have become timeless classics. The appeal and desirability of leather handbags among consumers are attributed to these designs and premium companies’ rich legacy and reputation.

Halal Compliance: A Game-Changer for Luxury Brands

However, in the context of the Islamic population, the halalness of leather materials becomes a pivotal consideration in purchasing decisions. The type of leather used in luxury handbags is often unclear, as many renowned brands do not explicitly disclose whether the leather originates from halal sources. For the Muslim population, the halalness of leather materials is a crucial factor in purchasing decisions. Luxury brands face several challenges in achieving halal compliance, primarily due to the need for transparency and traceability in their supply chains. Ensuring that leather materials and other components meet halal standards requires rigorous oversight and certification processes, which can be costly and time-consuming. Additionally, brands must adapt their production methods and source materials that adhere to halal guidelines, all while maintaining the quality and exclusivity that luxury consumers expect. Challenges include the potential use of prohibited materials, such as pigskin, and the lack of transparency in sourcing. Leather derived from pigs or other prohibited animals under Islamic law is strictly forbidden (haram). Even small components, such as trims or linings, can impact the halal status of a product. The absence of these assurances makes it challenging for Muslim consumers to confidently purchase luxury leather handbags.

However, halal-compliant leather, derived from permissible animals and processed under Islamic guidelines, offers an opportunity for brands to differentiate themselves. Consumer trust in halal-certified products is paramount, as it ensures that items meet strict religious guidelines. The growing Islamic middle class, particularly in Asia-Pacific and the Middle East, is increasingly seeking halal-compliant luxury goods. Transparency in material sourcing and adherence to halal standards can open significant market opportunities for brands aiming to attract Muslim consumers. This certification builds confidence among Muslim consumers, who rely on it to make informed purchasing decisions. By securing halal certification, luxury brands can strengthen their reputation and loyalty within this growing market segment.

The Role of Global Fashion Halal Standard (GFHS) in Empowering Brands

The Global Fashion Halal Standard (GFHS) serves as a transformative framework for luxury and mainstream fashion brands by ensuring compliance with halal principles while unlocking new opportunities in a growing market segment. Adopting the The Global Fashion Halal Standard for fashion product can significantly enhance a brand’s reputation by aligning it with islamic law, appealing to a broader audience that values such principles. This commitment to halal standards fosters trust and loyalty among muslim consumers who prioritize these values in their purchasing decisions. Moreover, it positions the brand as a leader in inclusivity and halal fashion, setting it apart in a competitive market. Its role extends beyond certification, empowering brands to embrace transparency, sustainability, and inclusivity while appealing to the global Muslim population and ethically conscious consumers. As the demand for halal fashion continues to grow, future trends are likely to focus on innovative materials and production methods that align with both halal principles and sustainability goals. Brands may increasingly integrate technology to ensure traceability and transparency in their supply chains, further enhancing consumer trust. Additionally, collaborations between fashion brands and halal certifying bodies could lead to the development of more comprehensive standards, addressing emerging ethical concerns and expanding the appeal of halal fashion to a wider audience.

1. Establishing Trust Through Halal Certification

The Global Fashion Halal Standard provides an internationally recognized certification that assures consumers of the halal compliance of fashion products, including leather handbags and accessories. By obtaining The Global Fashion Halal Standard certification, brands can enhance their reputation as they demonstrate a commitment to ethical standards and cultural sensitivity with halal assurance. This certification acts as a powerful endorsement, reassuring consumers that the brand is dedicated to maintaining high-quality, inclusive, and responsible alignment with islamic law fashion practices. As a result, brands can attract a more diverse customer base, including those who prioritize halal fashion and seek reassurance in the integrity of their fashion choices. The certification provides consumers with the confidence that the products they purchase align with their ethical and cultural values. This assurance can significantly influence purchasing decisions, as consumers are more likely to choose brands that have demonstrated a commitment to alignment with islamic law Additionally, the The Global Fashion Halal Standard certification can serve as a differentiator in the marketplace, encouraging consumers to select certified brands over competitors that may not offer the same level of transparency and trust.By adhering to The Global Fashion Halal Standard standards, brands can build trust with Muslim consumers who prioritize halal-compliant products, thus strengthening their reputation in the market.

2. Transparency and Material Traceability

- The Global Fashion Halal Standard emphasizes full transparency in the supply chain, ensuring that every stage—from sourcing raw materials to final production—is in line with Islamic principles.

- Brands adopting The Global Fashion Halal Standard standards can provide detailed information about their materials, such as whether the leather is sourced from halal-certified animals and processed in accordance with halal guidelines.

- This traceability appeals to both Muslim consumers and a broader audience concerned with ethical and sustainable practices.

3. Facilitating Market Access to the Global Islamic Economy

- The global Muslim population represents a significant and growing market for halal products.

- The Global Fashion Halal Standard certification enables brands to penetrate key markets in Asia-Pacific, the Middle East, and Africa, where demand for halal-compliant luxury and mainstream fashion is surging.

- By meeting halal standards, brands can participate in trade fairs, partnerships, and platforms dedicated to halal products, expanding their reach and market share.

4. Driving Brand Credibility and Global Recognition

- The Global Fashion Halal Standard certification serves as a hallmark of quality and integrity, enhancing the credibility of brands in the eyes of consumers and stakeholders.

- By adhering to The Global Fashion Halal Standard, brands align with a globally recognized standard, reinforcing their commitment to ethical, halal, and sustainable practices.